Isle Finance, incubated by BSOS, launches on the Hedera network.

Isle Finance starts ahead of the curve — incubated by BSOS, a fintech firm backed by Taiwan’s National Development Fund and trusted by major Apple supply chain vendors. Leveraging BSOS’s track record of over 300 enterprise clients and $15 million in monthly financing demand, Isle enters the market with built-in credibility and immediate access to real-world use cases.

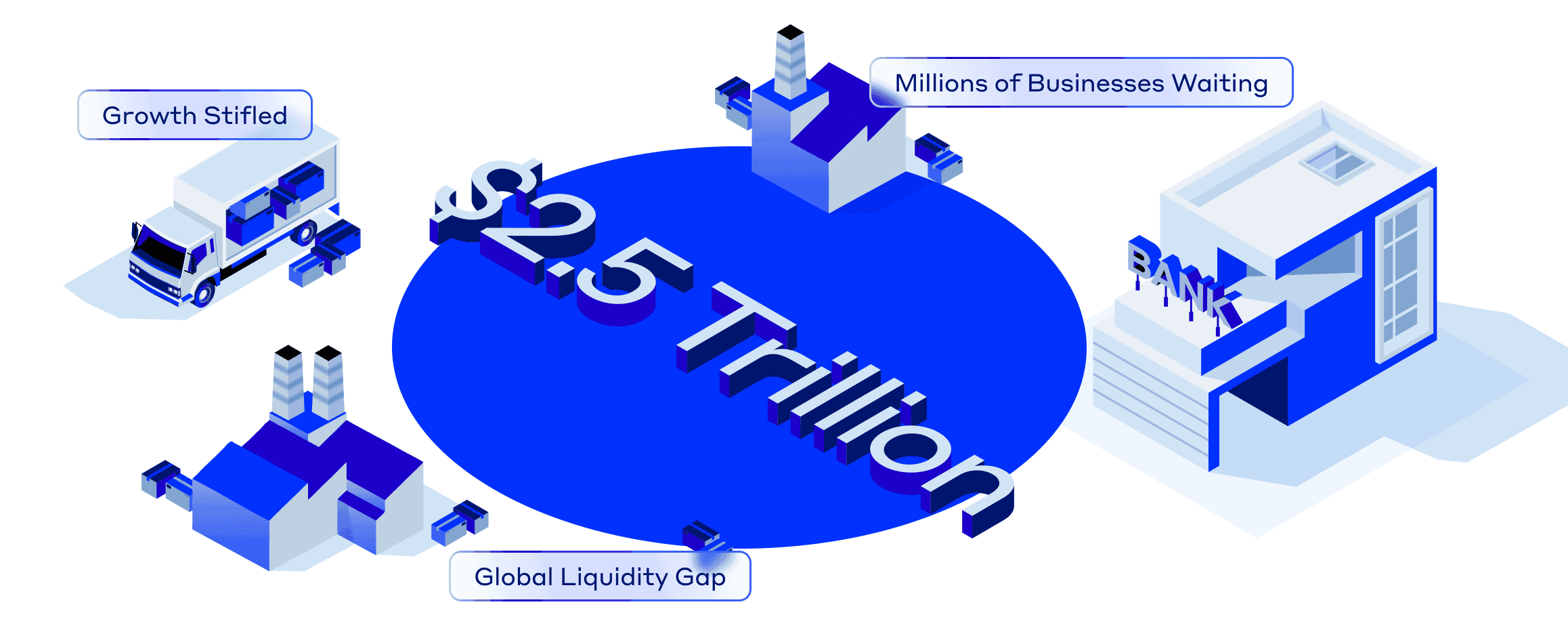

For a supplier in Taiwan, the game is simple. You ship a container of parts to a big American company, the goods arrive, and you send the invoice. But as you wait for weeks or months for the cash to arrive, you become an involuntary lender to a multi-billion dollar corporation. Multiply your situation by a few million other businesses and you get a $2.5 trillion global liquidity gap.

Today’s system is designed by bankers, for bankers, squeezing the people who actually make things. A group of supply chain veterans and crypto evangelists saw a way to bypass the current framework, giving birth to Isle Finance. It's a new, unique payment network on Hedera that utilizes untapped liquidity in the crypto markets to pay suppliers instantly.

The result is an “on-chain credit card machine” for suppliers and a three-sided market where everyone wins. Corporate buyers hold onto their cash, and vendors get paid immediately. Crypto investors who provide liquidity can earn stable yields from the predictable business of companies selling actual things to each other.

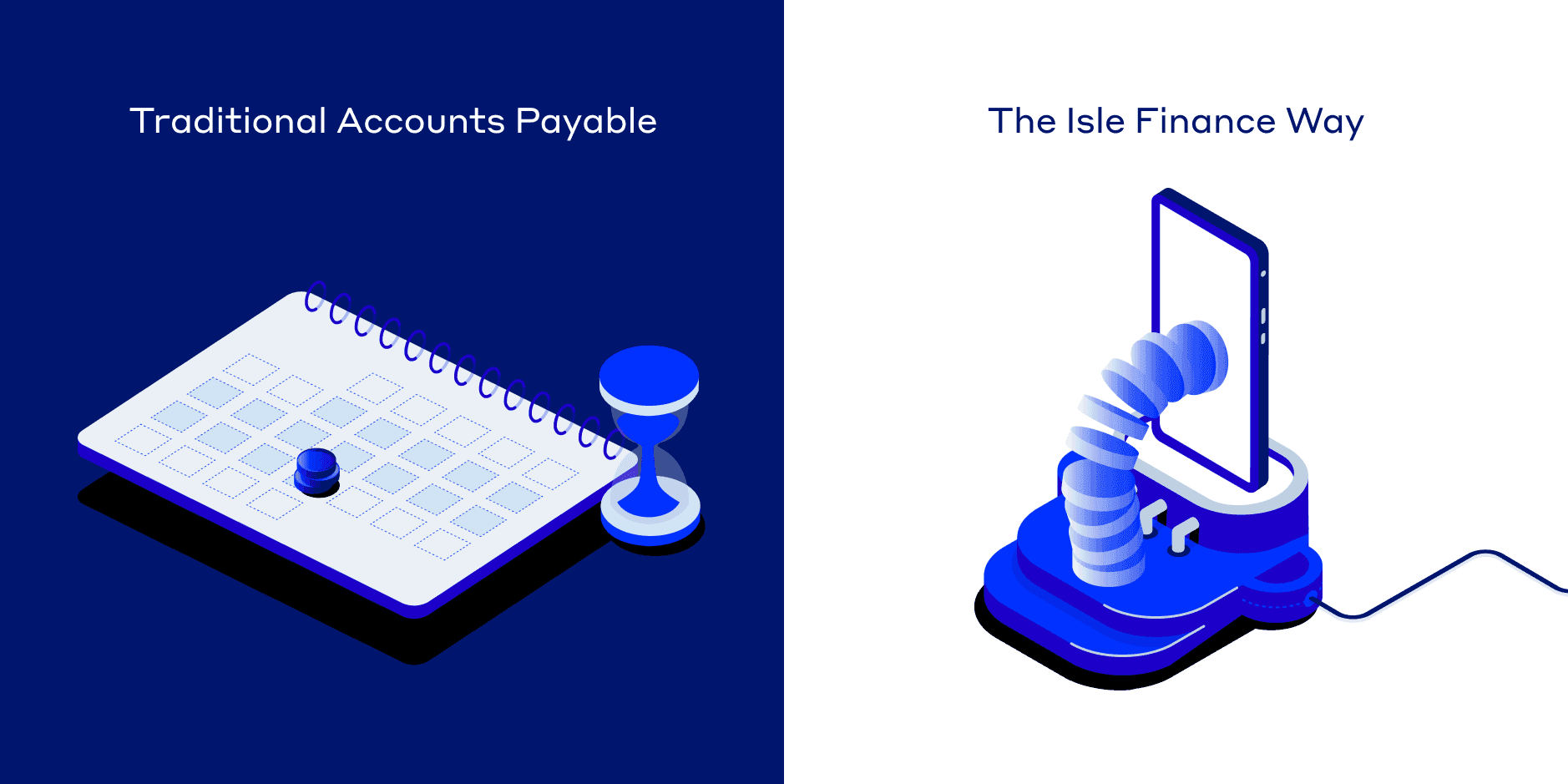

How Isle Finance is hacking accounts payable

Traditionally, a supplier had to use something called "Accounts Payable Financing" to get paid on time. This meant begging a bank for a loan, paying them interest, and waiting weeks for approval. All for the privilege of simply accessing money that’s already been earned. The premise of Isle Finance is to remove these hurdles and create more frictionless payments all around.

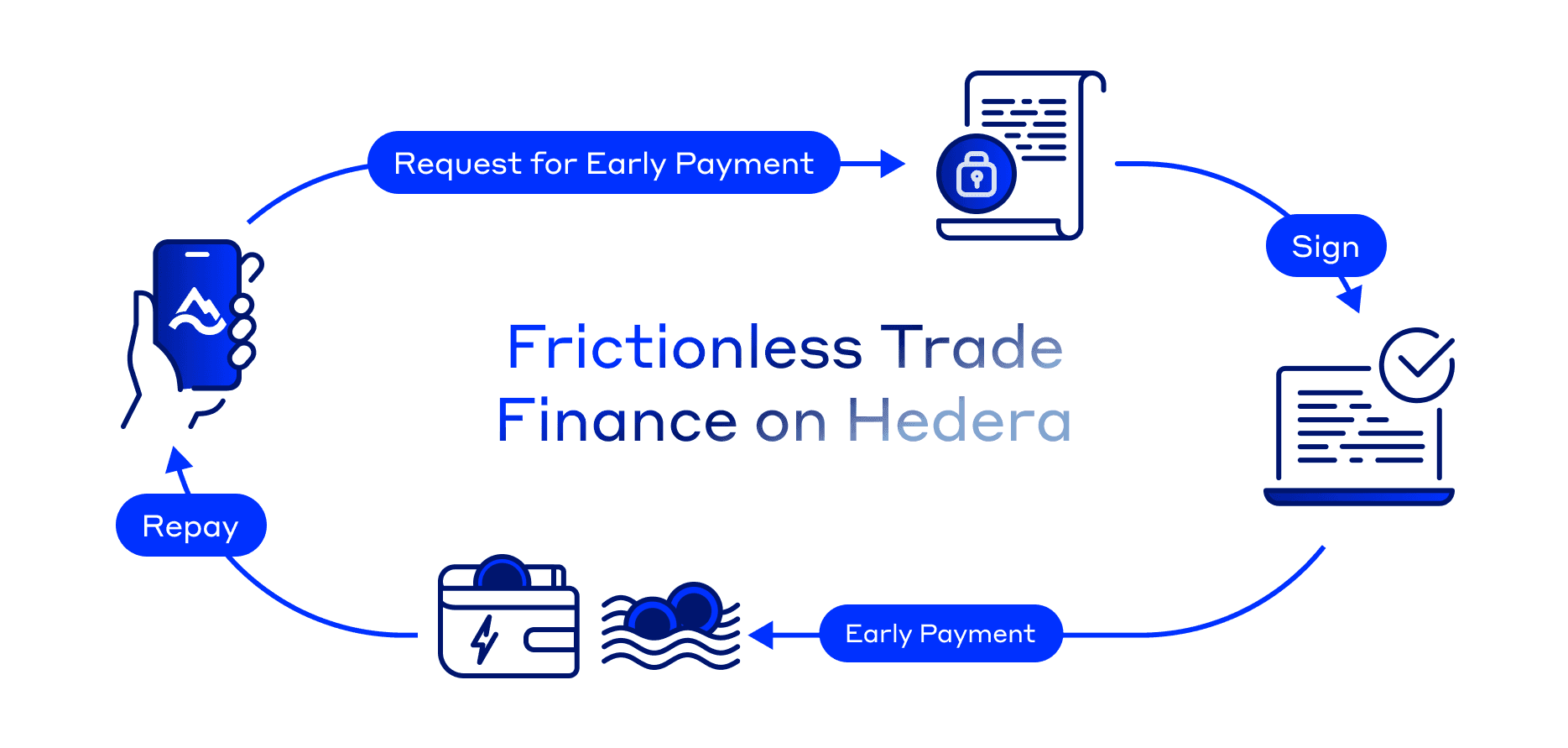

The Isle team has engineered a fast and automated four-step process that replaces Accounts Payable Financing:

- The supplier encrypts their invoice and puts it on the network, requesting an "Early Payment" for a small discount.

- The receiving company decrypts the invoice and approves it with a single, secure on-chain signature.

- The money from the liquidity pool is zapped across the globe to the supplier’s wallet in the form of stablecoins.

- The buyer simply repays Isle on the original due date. All parties get what they need, when they need it, with minimal friction and fees.

There’s no wire transfer fees, cross-border remittance delays, or loan applications. The buyer pays zero for this service and can earn token rewards based on protocol-defined participation tiers.

For the supplier, a process that once took months of chasing bankers is now over in minutes. This is what having an on-chain credit card machine means for businesses. It’s a system that replaces bureaucracy with a few clicks thanks to Isle’s vision and the Hedera network.

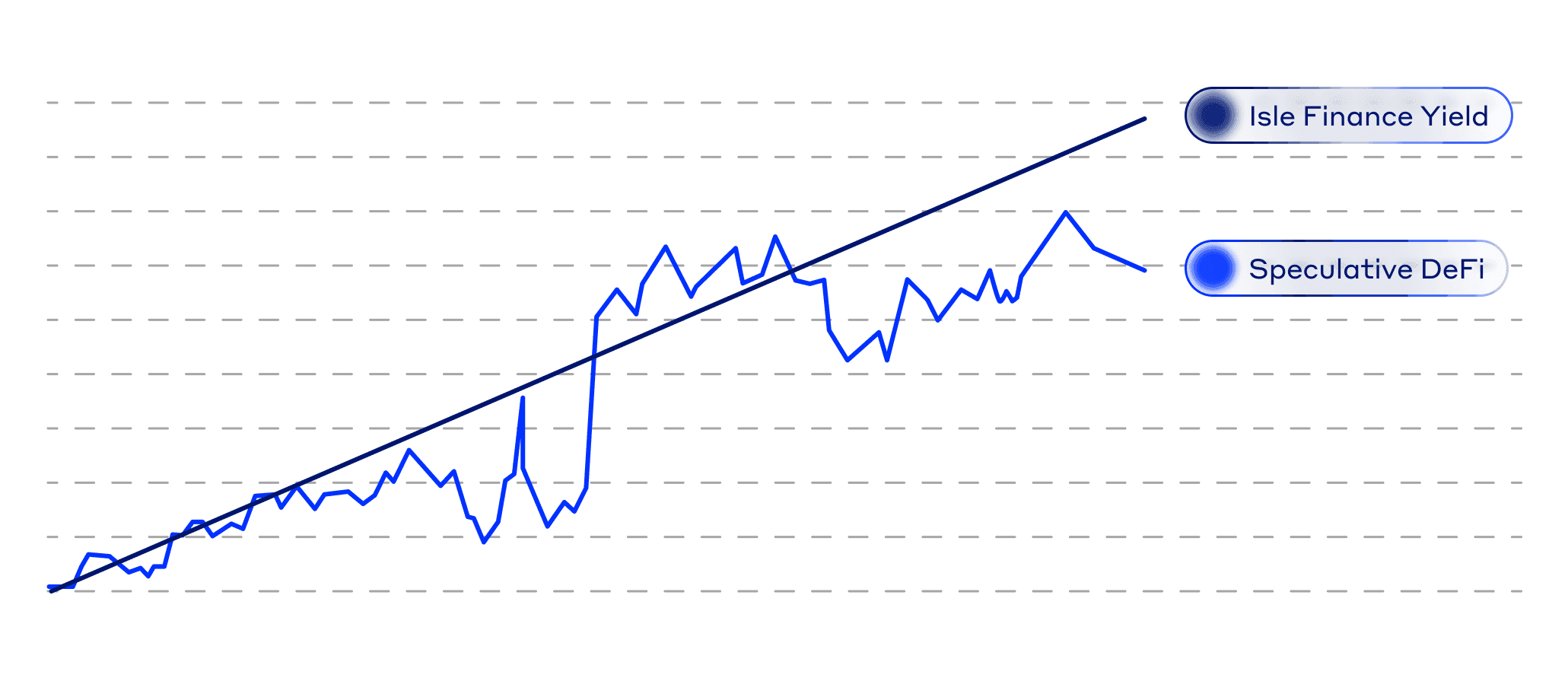

Crypto yields tied to real commerce and production

The irony of the DeFi lending boom was the sheer amount of brainpower focused on a tiny, $13 billion pond of crypto-to-crypto loans. Meanwhile, the global economy was creaking under the weight of a $2.5 trillion problem in trade finance that almost no one was paying attention to. You had a firehose of digital money looking for something to put out, and a multi-trillion-dollar fire burning in the middle of the global economy.

Isle simply decided to connect the two. Yield for investors comes from the 0.5% to 1.5% monthly discount a supplier is happy to offer to get paid instantly. After the network takes a small cut, this generates a projected 5% to 16% annualized return for liquidity providers, plus bonus ISLE token rewards. It's a yield backed by a container of electronics arriving at a warehouse, not some sketchy source code.

Isle is sidestepping risks that blew up some other crypto lenders by following a set of sensible, almost boring rules. Credit is only extended to established companies with over $100 million in revenue and no recent losses, with credit lines capped at just 3% of their revenue. The loans are short-term, never more than six months. An expert committee reviews every borrower, with pool admins like BSOS providing first-loss coverage to protect investors.

The right stack for businesses’ on-chain credit cards

Isle built its go-to-market strategy around a partnership with BSOS, a fintech player already deep in the trenches of Asia’s supply chain. Backed by a Taiwanese government fund and major Apple suppliers, BSOS brings over 300 corporate clients and $15 million in monthly financing demand to the table. And that’s all from day one of Isle’s launch.

For Isle’s system to work, crypto transaction costs need to be cheap and predictable. A CFO managing millions in payments needs to know the cost down to the fraction of a cent. That’s why Isle decided to integrate Hedera, the only network built to handle massive stablecoin transaction volumes with low, fixed fees that real businesses can model their finances on.

The BSOS partnership delivers a ready-made market, and Hedera provides the industrial-grade rails to service it. The Q2 2025 mainnet launch will activate a pipeline of crypto-funded supply chain finance, empowering a multi-million-dollar ecosystem of payments, invoicing, and real-world yield.

Isle’s ecosystem is a payments machine that feeds itself

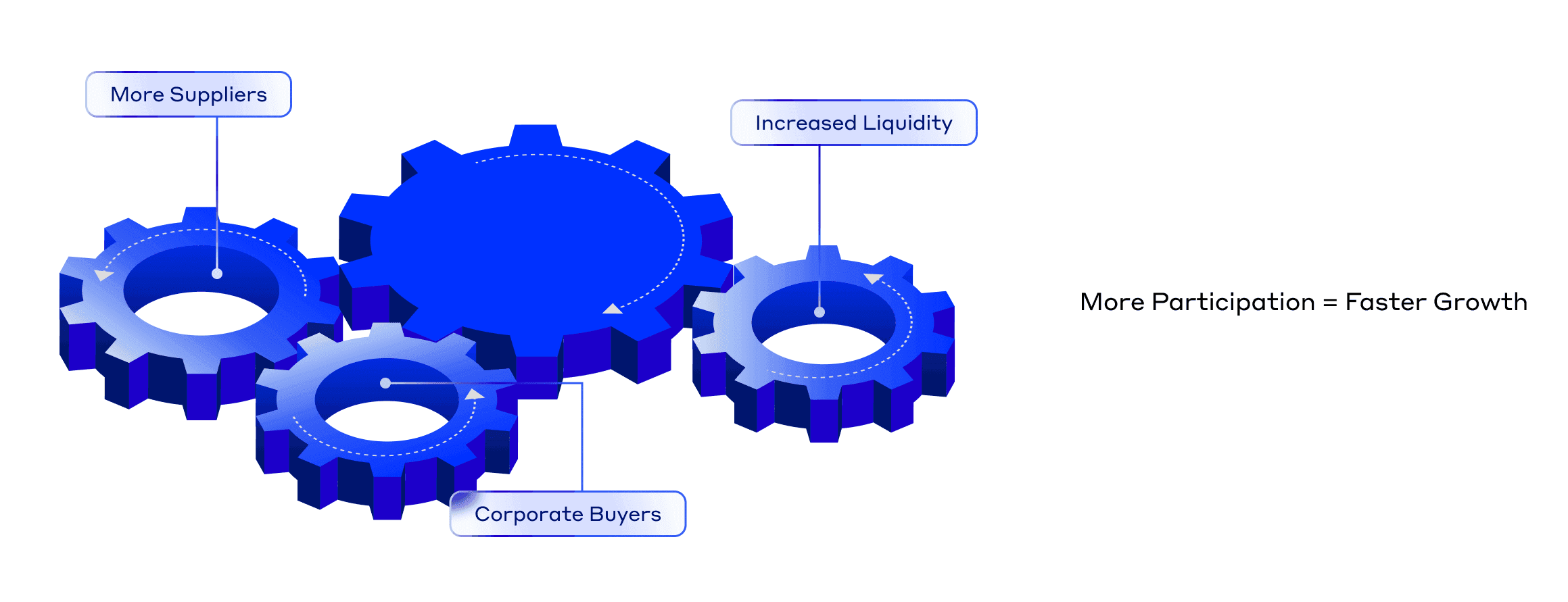

The true genius of the Isle model is how it turns everyone’s self-interest into fuel for the entire machine. The system is a flywheel that gets faster and more powerful over time, as more vendors, suppliers, business, and liquidity providers participate.

It starts with the buyers. The more a company uses Isle to pay its suppliers, the more discounts on future repayments. Businesses therefore have a reason to keep all their payments inside Isle Finance.

This creates a cascade of positive incentives. More buyers bring more high-quality deals, which attracts more suppliers looking for fast payments. The steady flow of discounted invoices creates stable, real-world yields, which pulls in more crypto investors.

The future of stress-free business-to-business payments

The story of global trade has always been about a $2.5 trillion traffic jam, created by a banking system that moves at the speed of paper. Isle Finance built a bypass, with their on-chain credit machine running on Hedera's low-cost rails. Money gets where it needs to be instantly, without the need for extractive TradFi middlemen.

For that supplier in Taiwan, the days of being an involuntary lender to a multi-billion dollar corporation are over. What Isle proves is that the real promise of blockchain technology is fixing broken parts of the real world and giving the people who make things a better deal.